Anyone can trade foreign currency on the Forex market. The information in this article can help to demystify forex and help you to earn profits from your trades.

Economic Conditions

Forex depends on economic conditions far more than futures trading and stock market options. Know the terminology of the forex market and how those terms apply to the political and economic conditions of the world. If you begin trading blindly without educating yourself, you could lose a lot of money.

Make sure that you adequately research your broker before you sign with their firm. Select a broker that has at least 5 years of experience and has proven to perform as well as the market has, if not better. This is especially important for beginners.

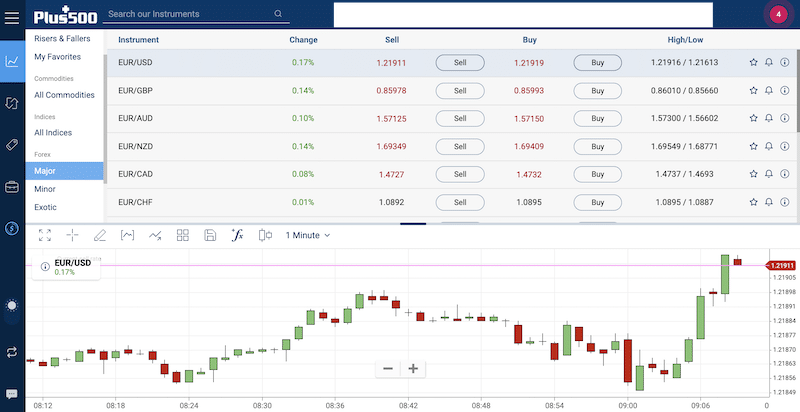

Don’t try to be involved in everything, especially as a beginner. Choose one or two markets to focus on and master them. It can quickly turn into frustration or confusion if you divide your attention. Focus instead on major types of currency pairs; this will up your odds for success, and help you build confidence in the market.

There is a lot more art than science when it comes to correctly placing stop losses in Forex. You need to learn to balance technical aspects with gut instincts to be a good trader. You will need to gain much experience before Forex trading becomes familiar to you.

The CAD is a relatively low-risk investment. It is often difficult to follow the news of another country. This can make forex hard sometimes. It is important to note that the currencies for both the Canadian and U.

S. That represents a better investment.

You should learn to read the market for yourself, and make your own analyses. Reaching your own conclusions independently, while taking other views into consideration, will set you up for success.

Realistically, the best path is to not get out while you are ahead. If you have a plan in place, then you can resist those temptations to stay in longer than you should.

There is no centralized market in forex trading. If you see what seems like an overall drop do not assume the market is about to crash. There is no panic to sell everything when something happens. Major events do have an influence on the market, but generally only on the currencies of the affected country.

Stop loss orders are essential in limiting potential losses. Too many traders are afraid to change a bad position.

You can find information on the market anywhere and all the time. You can search on Twitter, on the internet and even on various news channels. You can find it just about anywhere you look. Everyone wants to know what is happening with their money at all times.

Developing the right knowledge for trading takes time. You will lose money if you are not willing to persevere through difficult times.

Advance your critical thinking abilities so you can make conclusions on your data and from your charts. You need to be able to synthesize info from all sorts of sources in the Forex market.

Currency Pairs

Try to stay away from the more obscure currency pairs. It’s easier to buy and sell quickly with common currency pairs, because there are more people trading in the same market. You might not find buyers if you trade rare currency pairs.

When starting out in Forex, take plenty of time to practice your trading skills with demo platforms before experiencing the real thing. Use a demo account until you get the hang of things.

Approach the Forex market with common sense and keep a calm attitude towards it. Forget any dreams about getting rich quickly before you begin to trade on this market. Instead, know what you’re good at and stick to honing your existing skills. Ideally, you should take a conservative attitude and wait until you have acquired a solid body of knowledge prior to making any bold moves.

Make a trading plan. You will not be very successful if you don’t have a plan. If you create a well devised plan, you will less likely be tempted to trade on emotions.

Beginner traders should take special notes to never bet against the trends of the market. Another mistake is going against the market in regards to highs and lows. Trends can be important to follow as it allows you to ride with the market instead of against it. If you want to make solid trades, it’s hard enough to trade with the trend, and trading against the market trends will become very discouraging, very fast.

Watch your potential trades for a while to learn what a normal cycle looks like. Talk to a broker and seek out other expert advice before making any decision that you don’t feel completely comfortable with.

Begin trading using a mini account. This is somewhat like using a practice account, although it does involve using real money. This allows you to become immersed in the market and gain experience without risking too much of your investment funds.

It is a good idea to take a couple of days off every week, though if that is too hard, make sure to at least take a few hours off a day. Give your mind a chance to escape from Fibonacci ratios, stop loss orders and chart patterns, not to mention the hectic pace and constant action triggered by fluctuating currency values.

Learn about the truth behind the market. People will inevitably lose money at some point from trading. A large majority of first-time Forex traders will quit after their first major loss. If you see the market for what it really is, you will know that you need to keep going until you succeed.

Unlike traditional stock market trades, Forex involves global trading. You’ll be dealing with trades from all over the world. The tips laid out here can assist you to turn Forex into income you can make from your home, if you use self-control and patience.